A Mortgage Investment Corporation (MIC) is both an investment company and a lending company. Investors pool funds in a diversified, secured portfolio of commercial and residential mortgages. Mortgage Investment Corporations are designed for private mortgage lending. Most MIC mortgage loans are for residential properties like single-family homes and condominiums, commercial properties like office buildings, healthcare facilities, and stores, and land mortgages for new development.

How MICs Operate

The Canadian Income Tax Act (Section 130.1) outlines all MIC rules.

- 20+ shareholders

- No one shareholder holds more than 25% of the total capital

- At least half of MIC assets are Canadian residential mortgages and/or cash and insured deposits at Canada Deposit Insurance Corporation (CDIC) member financial institutions

- A MIC can invest up to 25% directly in real estate but can not develop land or do any construction

- The ceiling on real estate does not include real estate acquired through mortgage default

- A MIC is a flow-through investment vehicle, distributing 100% of the net income to shareholders

- MIC investments must be in Canada.

- MIC annual financial statements must be audited

Advantages of Investing in a MIC

Investing in a MIC provides several benefits.

- Every mortgage in the MIC is secured by real estate

- Stable cash flow

- Diversified portfolio of mortgages

- May provide higher yields than more traditional investments.

- 100% of MIC annual net income must be distributed to shareholders

- Invest as a self-directed RSP/ TFSA/RIF/RESP/LIF based on the Canadian Income Tax Act (Section 130.1)

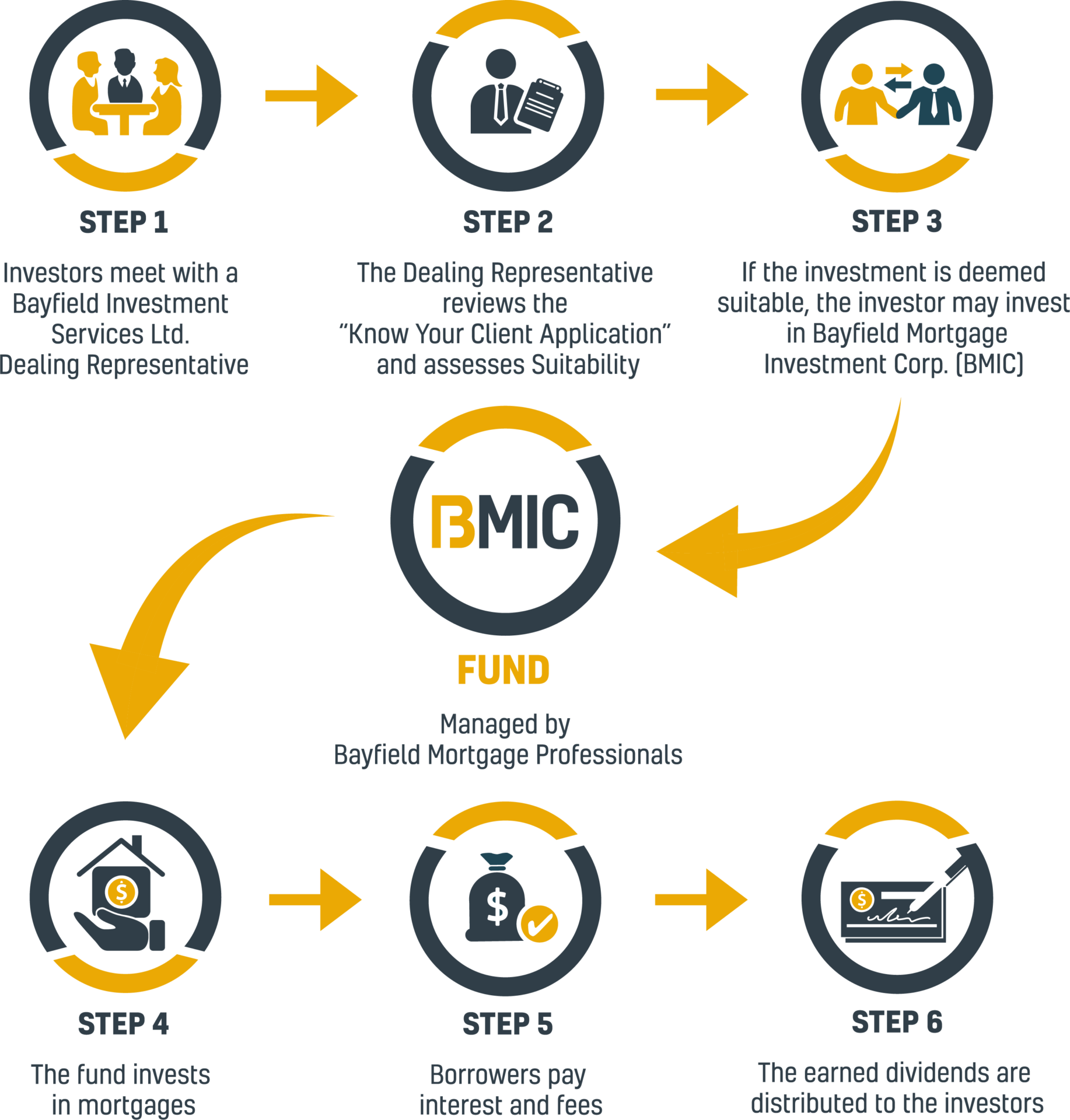

Bayfield Investment Services Ltd. (BIS) offers investors shares in Bayfield Mortgage Investment Corp. (BMIC).

Registered Accounts/Personal Accounts

Investing in government-registered plans, like RSPs, TFSAs, RIFs, RESPs, and LIFs, means your savings grow tax-free until you withdraw funds.

Plus, the contributions you make to an RRSP are not counted as taxable income. Registered plans have an annual contribution limit, capped at a percentage of your annual income.

For Further information about Bayfield Investment Services (BIS) and how to become an investor, please contact us online or call 604-533-9438.